Frequent quest– ions

Question

Answer

-

How Uplinq works

-

Pricing

-

Integrations

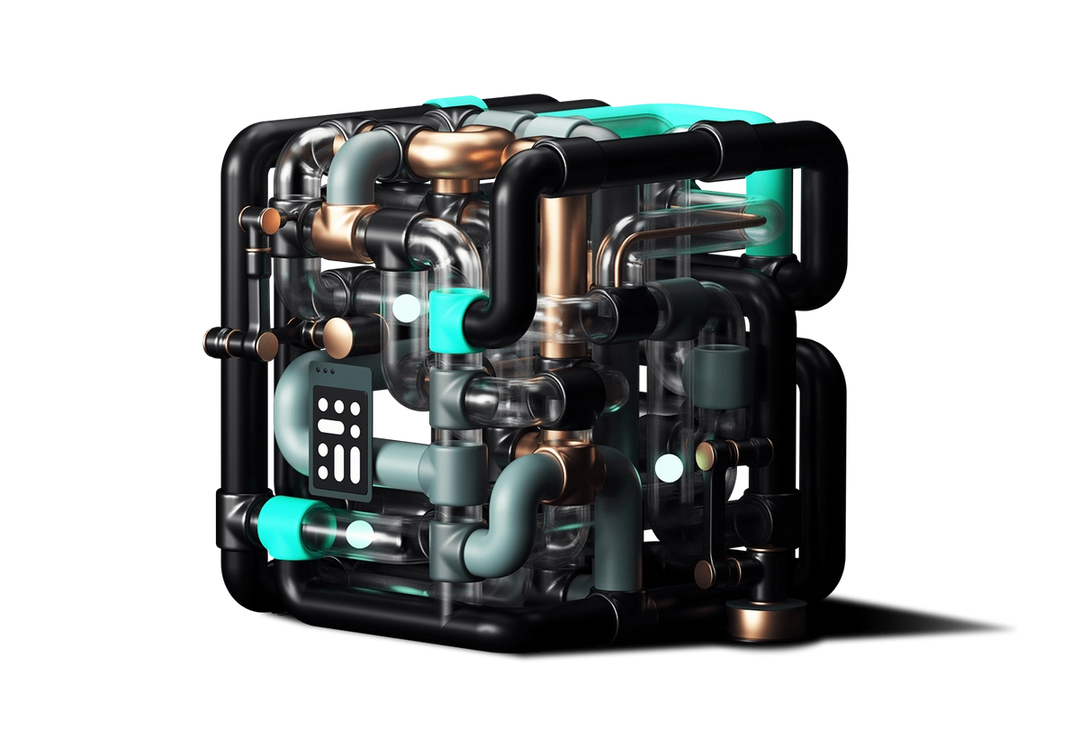

How Uplinq works

Every solution at Uplinq includes complementary support. You have a dedicated Account Manager assigned to you at onboarding who will support every area of your experience. We aim to respond to all inquiries within one business day.

At this time, we do not offer Accounts Payable services.

Cash bookkeeping is the process of tracking the money entering or leaving a bank account. Accrual bookkeeping is focused on tracking all money earned or owed. Larger companies typically implement accrual accounting, and the translation from cash to accrual can be painful. Because of this, Uplinq provides accrual bookkeeping from the start. Don’t worry if you’re used to looking at cash bookkeeping, as we will include the key cash accounts for you as well.

Currently, we work with customers in Technology, Insurance, Dental, Veterinary, and Real Estate. Reach out to us today to see if we can add your business to our growing list of supported business types.

As long your accounts are with institutions supported by our extensive network of integrations, then we can work with you.

Bookkeeping is the task of gathering, organizing, and categorizing your financial transactions so that they can be properly accounted for. Accurate bookkeeping allows you to better understand the financial position of your business and it is essential to file accurate tax returns.

Uplinq gathers, organizes, and categorizes you financial transactions, then provides you with accurate financial statements and metrics in near real time. Uplinq connects directly to the source of these transactions to make this process effortless.

Occasionally, we will encounter a transaction that we don’t understand. In these rare instances, we will need your input to accurately categorize the transaction. When we do, we’ll use the most convenient channel for you. If you have any questions, just let us know.

Because we have a live connection to your accounts, our automated bookkeeping solution categorizes transactions in real-time. Accuracy is critical, so we’ve implement a sophisticated review that delivers all of your financials on a weekly basis.

Yes. Many of Uplinq’s customers need assistance getting their books up-to-date. Your Account Manager can provide you with a custom quote based on your unique circumstances.

Every business is different, but our automated process can usually get you caught up in a suprisingly short time. Reach out to your Account Manager to learn more.

Uplinq can provide complete and accurate financail statements even if you are not using an accounting software.

Pricing

Our automated bookkeeping and financial intelligence plans are based on monthly subscriptions with pricing based on your expense levels and business needs. See our Pricing Page for more details.

We’re a young company, and are passionate about making the best tools available to other companies like us. If you’re a company that is pre-revenue, we offer special discount pricing. Contact us to learn more.

TBD

TBD

Our pricing is based on cash accounting, and includes all business expenses incurred in a given month.x

Our pricing is on a monthly basis, so If you ever decide to go in a different direction, we’ll make it easy on you by providing all of your financial data as you leave.

Integrations

We have partnered with Plaid to provide best-in-class access to financial institutions. We connect to nearly every financial institution in the US.

We have partnered with Plaid to provide best-in-class access to financial institutions. We connect to nearly every financial institution in the US.

We have partnered with CODAT to provide best-in-class access to Accounting providers. To see if your provider is on the list, click here.

We have partnered with Finch to provide best-in-class access to Payroll and HR providers. To see if your provider is on the list, click here.